Why Invest in Luxury Watches?

Understanding the Appeal of High-End Horology

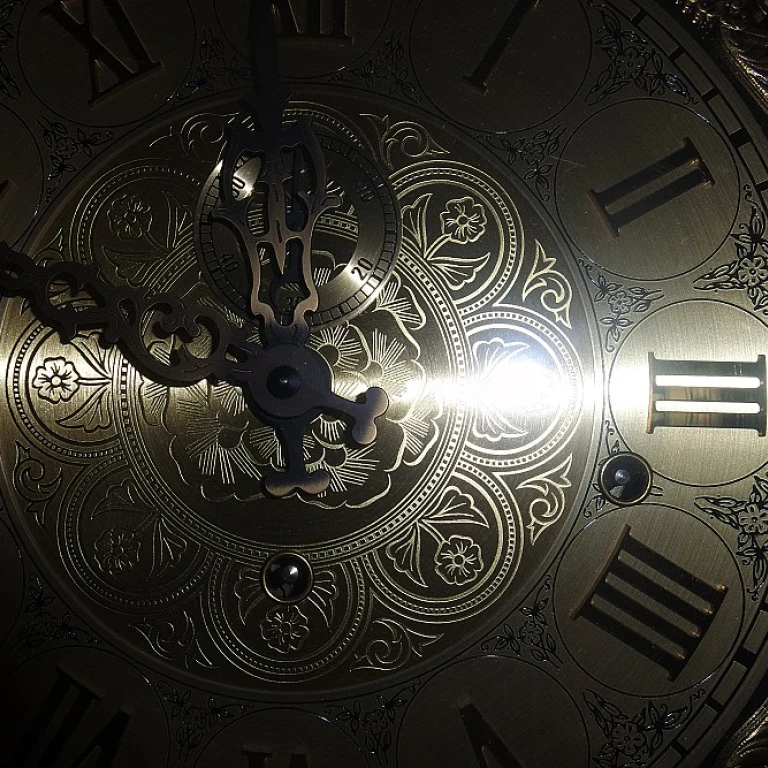

Investing in luxury watches has become an astute decision for many collectors and investors. But what makes high-end timepieces stand out as a promising investment? To begin with, luxury watches are not just mere instruments for telling time; they represent a fusion of art, engineering, and heritage that resonates with enthusiasts and connoisseurs worldwide.

One of the compelling reasons to invest in these exquisite objects is their ability to maintain or even increase in value over time. Unlike digital gadgets that quickly become outdated, mechanical watches are revered for their timeless craftsmanship and intricate mechanics. A well-chosen watch can transcend trends and offer financial security as its worth appreciates.

Moreover, luxury watches hold an intrinsic value due to the craftsmanship involved in their creation. Highly skilled artisans spend countless hours meticulously assembling each piece, ensuring that every component operates in perfect harmony. This meticulous attention to detail and dedication to quality is what differentiates luxury watches from mass-produced counterparts.

Another factor contributing to their investment appeal is emotional value. Watches often get passed down through generations, making them cherished heirlooms imbued with personal significance. This emotional attachment can further enhance their standing in the resale market, making them desirable collectibles.

A noteworthy point is also the robust durability many of these timepieces boast, often standing the test of time. This enduring quality ensures that not only do they retain their functional value, but they can also withstand the rigors of daily use. Discover more about

the toughest luxury watches that stand the test of time.

As we delve deeper into the investment landscape of luxury watches, aspects such as iconic models, the importance of brand reputation, the allure of vintage pieces, and savvy tips for investing will further elucidate why these horological treasures are worthy of your attention.

Iconic Models Worth Your Investment

Timepieces That Have Made Their Mark

When considering luxury watches as investment pieces, it’s crucial to recognize iconic models that have stood the test of time, both in terms of design and market value. These timepieces aren't just about their strikingly elegant designs; they are history encapsulated in metal and leather.

The world of iconic watches begins with brands like Rolex, Patek Philippe, and Audemars Piguet. These names not only resonate with prestige but are synonymous with investment-worthy timepieces. Take, for instance, the Rolex Submariner, famously known for its robustness and association with the world of diving. This watch isn't merely about telling time; it's part of a legacy that commands respect and value.

Similarly, the Patek Philippe Nautilus is heralded for its uniqueness and rarity, making it a coveted asset among watch enthusiasts. Its sleek design and storied inception make it a favorite choice for those looking at long-term investment prospects.

The Audemars Piguet Royal Oak, with its innovative craftsmanship and distinctive octagonal bezel, is another iconic model that continually appreciates in value. This watch disrupted the luxury market landscape with its bold design, carving out its niche and ensuring its place in the watch investment hall of fame.

Of course, understanding what moves the market is essential when investing in these masterpieces. With models that have garnered a cult following, ensuring that these watches remain timeless staples in any luxury watch collection is a given.

For more insights into why certain timepieces remain enthralling investments, take a look at the allure of

pre-owned luxury timepieces. Delve into how pre-owned watches are not just alternatives, but often, hidden gems waiting to be discovered.

The Role of Brand Reputation

Understanding the Brand's Influence on Investment Value

In the realm of luxury watch investments, the brand's reputation plays a pivotal role in determining the value and desirability of a timepiece. A prestigious brand name can often elevate a watch from being a mere accessory to a symbol of status and opulence. The allure of owning a piece from a revered manufacturer often brings with it a sense of exclusivity and prestige—a key driver for potential returns on investment.

Brands like Rolex, Patek Philippe, and Audemars Piguet have long established their dominance in the market through their consistent quality, innovative designs, and storied histories. They have accumulated decades, if not centuries, of trust and admiration amongst collectors and investors alike. Investing in a watch from such an iconic brand can be seen as a safer bet, as their reputation often contributes to a steady appreciation in value over time.

However, brand reputation is not just about historical prestige; it's also about contemporary relevance and brand management. Brands that continuously innovate and adapt to the modern market tend to maintain their position and value far better than those who rest on their laurels. Understanding how a brand capitalizes on its legacy while embracing change can provide insights into its investment potential.

For those venturing into the world of rare watch collections, assessing brand reputation is crucial. It can guide your investment decisions, helping you identify pieces that not only have present value but are also likely to appreciate over time. As discussed previously, iconic models from these esteemed brands are well worth your investment.

To delve deeper into how brand reputation impacts the value of luxury watches, consider exploring

rare watch collections. Such knowledge can arm you with the necessary insights to make informed investment choices, ensuring that your luxury watch collection is both rewarding and timeless.

Vintage Watches: A Timeless Investment

Exploring the Timeless Allure of Vintage Watches

When it comes to making a smart investment in luxury watches, vintage timepieces offer a compelling opportunity that continues to captivate collectors and investors alike. The allure of vintage watches lies not only in their historic significance but also in their unique characteristics and craftsmanship, which often set them apart from contemporary models.

A major factor contributing to the investment potential of vintage watches is their rarity. Unlike modern luxury watches, which might still be in production, vintage timepieces are no longer being manufactured, making them a finite resource. This scarcity can create a strong demand, especially for watches with iconic design elements or those associated with significant historical events or renowned personalities.

Another aspect to consider is the unique aesthetic and intricate detailing of vintage watches. Many collectors are drawn to the charm of older techniques and the patina that comes with time, giving each piece its own story and individuality. This appreciation for authenticity and distinctive craftsmanship can elevate the desirability and value of vintage watches over the years.

Investing in vintage watches also requires an understanding of the brand's legacy and its historical standing within the watchmaking industry. As discussed, brand reputation plays a crucial role in determining the long-term value of timepieces. Brands with a storied past and a track record of innovation and excellence often have vintage models that appreciate significantly over time.

However, venturing into the vintage market requires diligence. It is crucial to verify the authenticity and condition of the watch, as these factors greatly influence its value. Engaging with reputable dealers and conducting thorough research can help mitigate the risks associated with acquiring vintage pieces, ensuring that your investment remains sound and rewarding.

Ultimately, the charm of vintage watches extends beyond their potential returns. They offer a gateway to the past, allowing investors to experience a slice of history while benefitting from potential appreciation. Just like with iconic modern models, understanding the market dynamics and recognizing the intrinsic value of these classic pieces can significantly enhance your investment portfolio.

The Pre-Owned Market: Hidden Gems

Unveiling the Desirability of Pre-Owned Luxuries

When it comes to smart investments in the world of luxury timepieces, the pre-owned market holds a wealth of opportunities waiting to be discovered. For savvy collectors, delving into this segment isn't just about finding bargains; it’s about unearthing rare pieces that can appreciate over time.

Unlike brand-new models, pre-owned watches often boast a history and uniqueness that can enhance their appeal. This is particularly true for limited editions and discontinued models, which often see their value soaring over the years. Such historical allure can make pre-owned watches highly attractive alternatives to their freshly minted counterparts.

For those worried about authenticity and condition, fear not; the market has matured significantly, offering trusted platforms and retailers specializing in certified pre-owned watches. Many provide comprehensive services, including authentication and certification, ensuring peace of mind in your investment.

Another advantage of investing in pre-owned watches is the ability to gauge market trends with more accuracy. Unlike current collections, whose value trajectories are still unfolding, pre-owned watches often come with established market performance histories. This allows collectors to make informed decisions based on a watch’s resale value, a crucial aspect you can learn more about in our

detailed analysis.

In summary, the pre-owned market is a treasure trove for watch enthusiasts. By investing wisely, you can curate a collection that's not only rich in history but also solidifies your status as a connoisseur of fine timepieces.

Tips for Investing in Luxury Watches

Guidelines for Acquiring Luxury Timepieces

Building a portfolio of luxury watches can be both rewarding and financially savvy. To ensure your investment pays off, consider the following guidelines:

Start with Research: The first step is to gather information about the luxury watch market. Stay informed by reading articles, forums, and following reputable watch dealers and auctions. Knowledge is a crucial ally when selecting a timepiece that will not only retain value but also appreciate over time.

Focus on Established Brands: As discussed earlier, brand reputation plays a significant role in the watch's investment potential. Brands with rich histories and proven track records, such as Rolex, Patek Philippe, and Audemars Piguet, often offer more stable investments. A watch’s association with a powerful brand can significantly influence its desirability and resale value.

Consider Timeless Designs: Certain iconic model designs never go out of style, and their timeless appeal makes them more likely to retain or increase in value. Think of classic designs such as the Cartier Santos or the Omega Speedmaster.

Be Patient with Vintage: If you’re eyeing vintage watches, patience is key. The vintage market can be volatile, and costs fluctuate. Stay vigilant and buy when prices are favorable to ensure you’re securing a piece that will grow in value.

Evaluate Pre-Owned Opportunities: The pre-owned market offers hidden gems at potentially more accessible prices. It's important to authenticate watches and verify their condition and provenance. A well-maintained pre-owned watch might outperform new pieces in terms of appreciation.

Use Online Platforms Wisely: Leverage online resources to compare prices, read reviews, and even set alerts for watches you’re interested in. Just be cautious and ensure any transactions are conducted through reputable sources.

With a careful and measured approach, you can navigate the luxury watch market confidently, turning your passion into a profitable investment.