Why Luxury Watches Make Great Investments

The Timeless Appeal of Luxury Watches

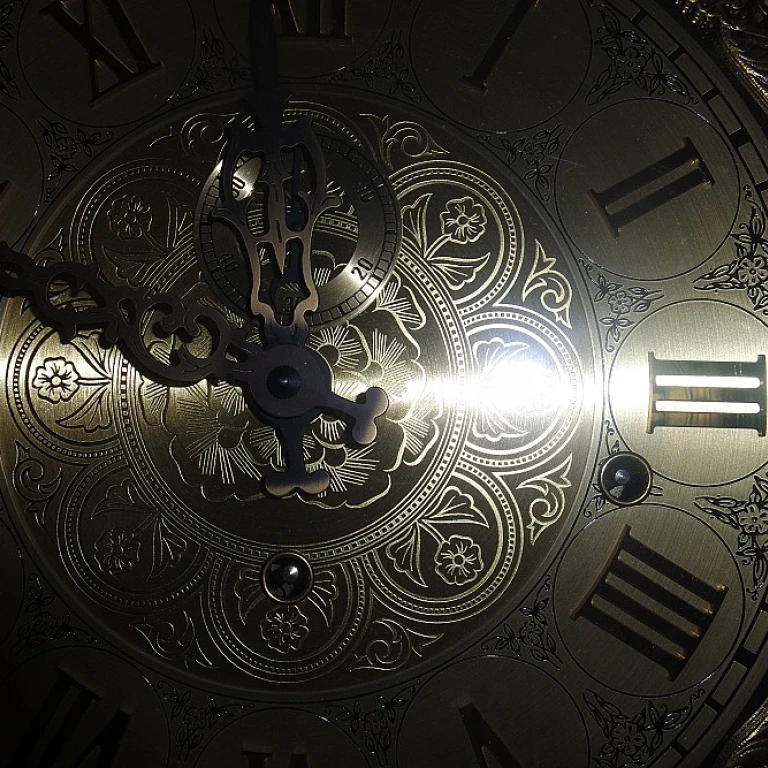

Luxury watches have long been cherished not only for their craftsmanship and aesthetic appeal but also for their potential as sound investments. In a world where trends come and go, these exquisite timepieces offer a unique blend of tradition, innovation, and scarcity that can lead to significant financial returns over time.

One of the key reasons luxury watches make great investments is their ability to retain, and often increase, in value. Unlike many other consumer goods, a well-chosen watch can appreciate, making it a tangible asset that can be passed down through generations. This appreciation is driven by a combination of factors, including brand prestige, limited production runs, and the enduring allure of iconic designs.

Investing in luxury watches also provides a sense of security and diversification for your portfolio. While stocks and real estate can be volatile, the watch market has shown resilience, particularly with models that have a storied history or are associated with significant milestones. As you explore the market, understanding the cost of luxury timepieces can provide valuable insights into potential investment opportunities.

As we delve deeper into this topic, we'll explore iconic models that have stood the test of time, offer guidance on spotting a good investment watch, and weigh the pros and cons of pre-owned versus new timepieces. Whether you're a seasoned collector or a newcomer to the world of horology, understanding these aspects will enhance your investment strategy and appreciation for these magnificent creations.

Iconic Models That Stand the Test of Time

Timeless Icons: Models That Withstand Decades

When it comes to investing in luxury watches, it pays to know which iconic models have unwavering value. These timepieces aren’t just beautiful; they are often considered the holy grail for collectors and investors alike, seamlessly transcending trends to stand the test of time. From classic Rolex models to revered Patek Philippe editions, the enduring allure of these watches makes them solid long-term investments.

Rolex's Submariner, for instance, is a quintessential classic that has been adored for its robustness and timeless design. Launched in the mid-20th century, its legacy continues strong, thanks to its trademark durability and recognizable aesthetics. Rolex's ability to blend form with function has made this model a regular pick for investors seeking to combine elegance with a robust financial return.

Likewise, the Patek Philippe Nautilus showcases how luxury watch models can combine artistry with innovation. Known for its unique porthole design, this model not only impresses enthusiasts with its craftsmanship but also holds a compelling market value. Its rarity and reputation for excellence frequently create higher-than-average appreciation rates.

Moreover, for potential investors wanting more insight into the

investment-grade luxury watches that yield significant returns over time, delving into the subtleties of market appeal and desirability can provide valuable guidance.

It is crucial to remember that some brands have created timepieces that not only maintain but often appreciate in value, influenced by their heritage, craftsmanship, and the philosophy that 'you never actually own a Patek Philippe; you merely look after it for the next generation.' It is sayings like this which root deeply in the philosophy of collecting, ensuring the legacy lives through every tick of the watch.

When examining these iconic models, consider the changing dynamics of the watch market, as discussed in subsequent sections. Also, it may be worthwhile to consult resources that further explore how specific features, materials, and designs impact watch valuation over time. This enriched understanding can significantly aid one in making more informed decisions regarding investment-grade chronometers.

Understanding the Watch Market

Decoding the Dynamics of the Watch Market

Understanding the strategies and movements within the ever-evolving watch market is crucial when deciding which timepieces to invest in. While discussing why luxury watches make sound investments and exploring iconic models, it's also important to consider the broader economic context that influences these trends.

Luxury watches hold their value over time due to factors like craftsmanship, brand prestige, and demand. However, other external influences drive the market, such as economic shifts, changes in fashion trends, and even celebrity endorsements. As an investor or enthusiast, being aware of these factors allows for better decision-making. For instance, certain industry reports and auction results might highlight which brands are gaining popularity and appreciation.

Indeed, shifting our focus to the rarity of watches and understanding the nuances of limited editions can bring clarity to the idea of a timeless investment. Learn more about how exclusivity plays a significant role in enhancing a watch's worth by exploring

this insightful article.

When evaluating the watch market, remember that it is not just about selecting the right brand or model. Timing your purchase and sale – understanding market cycles – also profoundly impacts your potential return. Luxury timepieces are not merely about possession but acquiring an asset that could yield substantial benefits over time.

Spotting a Good Investment Watch

The Art of Identifying a High-Value Timepiece

Finding the right watch that not only captivates with its aesthetics but also promises a good return on investment is an art in itself. As discussed earlier, luxury watches hold significant investment potential due to their enduring value and brand prestige. However, not every watch is guaranteed to appreciate in value.

A key factor in spotting a good investment watch is understanding the craftsmanship behind it. Top-tier craftsmanship is essential, as it not only enhances the watch's durability but also its desirability. Brands with a rich history of meticulous craftsmanship tend to produce watches that maintain or even enhance their value over time.

Limited editions often attract collectors and investors alike. This is because scarcity can drive demand, making these watches more valuable. When seeking out a limited edition, ensure that the watch has a unique feature or collaboration that sets it apart from standard models.

Another aspect to consider is the watch's provenance. A piece with a story, especially if it has been owned by a celebrity or played a part in an iconic moment, can command a higher premium. Authentication and verification are crucial here, as this ensures the watch's history genuinely adds to its value.

Furthermore, consistent maintenance and care are paramount. Regular servicing by certified professionals ensures that the watch remains in pristine condition, thus preserving its investment value. For more on how to care for your luxury timepiece, have a look at our dedicated guide on

protecting your investment.

Ultimately, spotting a good investment watch requires a mix of research, intuition, and a keen eye for detail. By focusing on quality, heritage, and uniqueness, you're more likely to acquire a timepiece that not only tells time but also enriches your investment portfolio.

Pre-Owned vs. New: What to Consider

Evaluating Pre-Owned and New Watches: Key Considerations

When considering investment in luxury watches, deciding between pre-owned and new models can significantly impact your portfolio. Both options have distinct advantages, and understanding their nuances will guide you in making a more informed decision.

Firstly, pre-owned watches often offer an allure of rarity and history, qualities not easily found in new models. Iconic watches, which we've previously discussed, sometimes appreciate with age due to their storied pasts and discontinued status. Collectors often seek these pieces for their potential to stand the test of time both mechanically and financially. Furthermore, the pre-owned market provides an opportunity to own a high-value timepiece at a reduced price, making it a smart entry point for new investors.

On the flip side, new watches come with the guarantee of warranties and often incorporate the latest in horological advancements. They possess a fresh market appeal and may include limited editions that become future collectibles. Nevertheless, new timepieces might face initial depreciation once they leave the showroom, which necessitates careful consideration and a strategic approach.

Another key factor to weigh is the authenticity and condition of the watch. With pre-owned watches, a meticulous examination of their history, past ownership, and service records is essential. On the other hand, buying new from authorized retailers often ensures authenticity without requiring extensive due diligence.

Finally, the market pace plays a crucial role. If you have a keen interest in current trends and the latest releases, new models might align better with your strategy, whereas pre-owned options might better suit those favoring enduring classics known for their lasting value. Understanding these dynamics will empower you to identify a sound investment watch that aligns with your personal goals and the broader trends in the luxury watch market.

Top Brands to Watch For

Brand Prestige and Performance

Navigating the realm of luxury watches reveals certain brands that have consistently demonstrated notable performance in terms of investment value. Understanding the brand's legacy is crucial—these are names that have built trust and prestige over decades, sometimes even centuries. When considering which brands to keep an eye on, you want to look for those that have a track record of both innovation and timeless appeal.

Rolex is frequently hailed as the champion of investment watches, and rightly so. Its timeless designs, coupled with a robust reputation for quality and durability, make it a staple in any discussion about valuable timepieces. Additionally, the brand's watches often appreciate in value over time, making them a reliable choice.

Patek Philippe is synonymous with exquisite craftsmanship and exclusivity. Known for its complex movements and limited productions, Patek Philippe watches are often seen as heirloom pieces, handed down through generations. Their scarcity drives demand, thereby safeguarding their value.

Audemars Piguet is another esteemed name worth mentioning. The brand's iconic models, such as the Royal Oak, have redefined sports luxury and continue to command high secondary market prices. The blend of avant-garde design with high-quality materials contributes significantly to their desirability among collectors.

Omega, with its strong historical affiliations with space exploration and the Olympic Games, captures both the adventurous spirit and technical precision enthusiasts seek. Omega's commitment to innovation, while maintaining a classic aesthetic, ensures its pieces remain highly sought after.

Finally, consider

Cartier, the epitome of elegance and classic style. Known more for their jewelry, Cartier watches such as the Santos and Tank series have a unique charm that attracts both fashion-forward individuals and traditional collectors alike.

These brands represent a small selection in a vast market, each offering a unique selling proposition that can serve as a safeguard for both value retention and appreciation. When choosing an investment watch, prioritizing brand reputation and historical performance can aid in making an informed decision that aligns with financial aspirations.