The Heritage Halo: Why Vintage Heirloom Watches Skyrocket in Value

The Allure and Appreciation of Timeless Timepieces

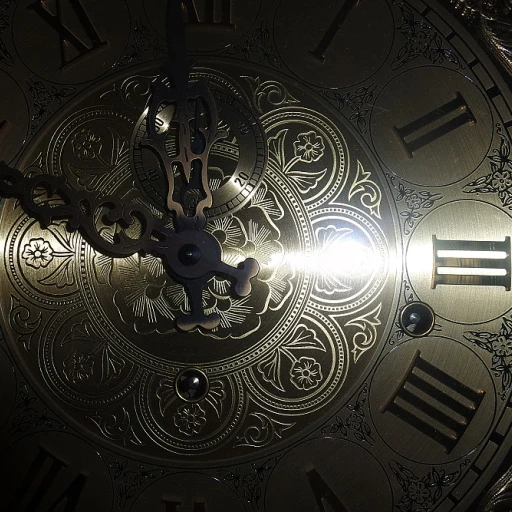

The enchanting world of vintage heirloom watches is one that radiates with history and craftsmanship. As a symbol of heritage and prestige, these watches see an astonishing upsurge in value, making them a focal point for savvy investors. According to a 2021 report from Art Market Research, vintage luxury watches outperformed many other alternative investments, seeing an average annual return of 5% to 8%. This 'Heritage Halo' can be attributed to an array of factors, which includes the rarity of specific models, the provenance attached to culturally significant pieces, and the burgeoning community of passionate collectors.

Rarity and Exclusiveness: The Value Drivers

- Limited Edition Releases – The fewer pieces available, the higher the demand.

- Discontinued Models – When watch lines stop production, the existing models become collectible items.

- Patina Development – Age-induced characteristics can add a unique charm that is highly prized.

Experts often note, referencing significant auction sales, that rare models such as the Rolex Daytona or the Patek Philippe Nautilus have experienced unprecedented value gains, solidifying the investment potential of luxury watches. For instance, Phillips in Association with Bacs & Russo announced that a Rolex Daytona, once owned by Paul Newman, fetched $17.8 million, an impressive testimony to the allure of scarcity and celebrity provenance.

Provenance and Historical Value: The Intangibles That Count

It's not just the mechanics and design that define the value of a vintage heirloom watch, but often its story. Watches that were gifts from notable figures or worn during significant historical events carry an indisputable gravitas. Horological scholars cite examples such as the Omega Speedmaster, known as the 'Moonwatch', attributing its 300% value increase over the past few decades not just to its design but also to its storied space mission history. Such intangible factors can cause a seismic shift in an heirloom watch's monetary worth and collector appeal.

Cultural Shifts: The Modern Renaissance of Vintage Watches

Today's market for vintage heirloom watches is seeing a cultural shift that emphasizes not just the art of watchmaking but also the ethos of sustainable luxury consumption. A recent study by Bain & Company highlighted that the luxury second-hand market is growing at 12% per year, nearly twice the rate of the primary luxury market. Collectors are increasingly attracted to the environmental and ethical implications of investing in pieces with enduring value, setting the stage for an exciting upturn in the market of vintage heirlooms that go beyond mere sentimental value to become potent financial assets.

Investor's Timepiece Timeline: From Acquisition to Auction

Charting the Milestones of Watch Investment

For aficionados of luxury watch investment, the journey from acquisition to auction is a blend of strategic selection, timing, and market observation. An impactful acquisition often starts with identifying timepieces with a strong heritage — a buzzword that resonates powerfully with enthusiasts and collectors alike. The luxury watch market has seen a consistent expansion, with the global luxury watch market size valued at $23.2 billion in 2018, and expected to reach $51.31 billion by 2027, according to Allied Market Research. This demonstrates a clear upward trajectory in the investment potential of luxury watches.

Navigating the Auction Landscape

When delving deeper into this niche market, one cannot ignore the pivotal role of reputable auction houses like Sotheby's and Christie's. The prices of vintage heirloom watches have often surged at auction, propelled by their rarity and historic value. For instance, a Rolex Daytona once owned by Paul Newman was sold for $17.8 million in 2017 at Phillips Auction, far surpassing its initial estimates and underscoring the skyrocketing value of vintage pieces with a compelling backstory. This exemplifies the significant return on investment (ROI) that vintage watches can yield under the right circumstances.

The Strategic Timing of Sales

Timing the sale of a vintage timepiece is equally critical. Market demand fluctuates, and selling during a peak period can make a substantial difference in ROI. Analysis from auction results reveals that vintage watches from the 1950s to 1970s have seen an impressive appreciation, indicating that watches from these eras are ripe for investment. However, it is crucial to monitor market trends and news within the watch community to optimize the timing of a sale.

Securing and Authenticating Notable Pieces

Before a watch reaches the highlight of an auction, it must pass through stages of verification and authentication — a non-negotiable step in solidifying its value. The provenance of a watch, detailed records of its history and ownership, can drastically influence its appeal to potential buyers. A watch with a well-documented lineage or one that has graced the wrist of a celebrity may command prices well above its physical value. Such attention to detail ensures investor confidence in the piece's authenticity and value proposition.

Understanding Market Volatility and Liquidity

Finally, the savvy investor recognizes the interplay between market volatility and the liquidity of their assets. Vintage watches can be a less liquid investment compared to traditional investments, but with the right piece and timing, they can offer substantial returns. The rarity of specific models, such as the Patek Philippe Reference 1518 in stainless steel, of which only four are known to exist, can translate into massive demand during auctions. Statistics from the luxury investment market highlight noticeable spikes in attention and capital allocation towards alternative assets like vintage watches during periods of economic turbulence.

Beyond Sentiment: The Quantifiable Upturn of Vintage Heirloom Collections

Unwrapping the Financial Upswing of Heirloom Watch Portfolios

When one transitions beyond the emotional allure of vintage heirloom watches, the panorama of their financial ascent is striking. Notably, The Wealth Report 2021 by Knight Frank stated that luxury watches had an average value uplift of 170% over the past 10 years. This growth is not purely incidental; it is underpinned by a combination of rarity, condition, brand heritage, and historical significance, crafting a lucrative investment avenue for connoisseurs.

Finding Fortune in the Tick of Time: The Actual Numbers

To distill the value proposition, consider the trajectory of a 1950s Rolex Submariner which, according to a 2020 report from Paul Altieri's Bob's Watches, surged in price by nearly 600% over the last 20 years. This emphasizes a key strategic perspective for investors: iconic models from stalwart brands often see an exponential increase in value, making them prime targets for investment portfolios.

- Rarity and exclusivity are paramount in valuation.

- Condition, originality, and provenance can dramatically affect price points.

- Historical timepieces linked to prominent figures can command premium margins.

Striking Gold with Patina: The Metrics of Age and Authenticity

The adage 'age like fine wine' holds merit in the realm of vintage heirloom watches. Pieces with a distinct patina or those retaining original components can yield incredible returns. An unpolished dial or a faded bezel, often referred to as 'tropical' in collector circles, can exponentially raise the stakes at high-profile auctions. This underscores the fundamental lesson for collectors: the market treasures authenticity and age, and such pieces should be targeted with precision.

The Powerhouse Brands and Their Unshakeable Valuation Thrust

Brand power cannot be underestimated in this echelon of luxury collecting. Patek Philippe and Rolex are commonly cited in discussions surrounding luxury watch investments. For instance, a vintage Patek Philippe Reference 1518 in steel was auctioned by Phillips for an unparalleled $11 million. These brands consistently outperform the market, evidencing strong historical ROI and justifying their dominant position in an investor's cache.

In conclusion, the financial upsurge seen across vintage heirloom watch portfolios is not only sustained but also heightened by specific marques and models. Acknowledging the statistics and trends is pivotal for investor strategy, aligning passion with pragmatism in the pursuit of horological excellence.

Case Studies: Heirloom Watches That Broke Records

Record-Breaking Sales at Renowned Auctions

The world of vintage heirloom watches is replete with stories of record-breaking sales that enchant collectors and investors alike. The auction floor has seen unprecedented upswings in the value of rare vintage watches, with provenance playing a key role in their desirability. One remarkable example involves a Rolex Daytona once owned by Paul Newman, which sold for an astonishing $17.8 million in 2017, vastly surpassing its pre-sale estimate. This sale set a new benchmark for luxury watch auctions, reinforcing the fact that the investment potential of watches with significant history is phenomenally high.

Statistics consistently demonstrate the lucrative nature of investing in heirloom watches. According to the Knight Frank Luxury Investment Index, collectible watches gained 5% in value over twelve months, with some brands achieving appreciations as high as 60%. These figures underscore the financial merit that collector-grade timepieces could potentially offer.

Iconic Models and Their Investment Trajectory

- Patek Philippe Reference 1518: A stainless steel model garnered approximately $11 million at auction, highlighting the brand's reputation for creating investment-grade timepieces.

- Rolex 'Bao Dai' Reference 6062: This timepiece, originally owned by the last emperor of Vietnam, fetched over $5 million, showcasing the enormous allure of watches with royal connections.

These figures not only speak to the rarity and prestige of such watches but also their capacity to yield substantial returns. They exemplify the investment potential inherent in vintage heirloom watches, which is a critical insight for passionate collectors.

Unveiling High-Valued Gems: Notable Auction Discoveries

Beyond known celebrity and royal watches, sometimes the allure lies within undiscovered gems that surface to the market. Collectors often revel in the surprise of a high-performing lot that surpasses all expectations. For instance, a recently discovered vintage Heuer ‘Autavia’ sold for nearly 30 times its estimated value, leaving industry experts and enthusiasts alike in awe. This highlights the dynamic and unpredictable nature of investing in vintage timepieces and suggests that there is always the potential for enormous return on investment.

Preserving Elegance and Value: Care and Maintenance Tips for Watch Investors

Meticulous Maintenance: Ensuring Longevity in Your Luxury Investment

As a devotee of luxury watches, you are acutely aware that vintage heirloom watches are not just time-telling devices; they are intricate works of art with a story. This history contributes to their exponential rise in value, but their physical condition plays a critical part as well. Statistically, watches in mint condition see a higher value appreciation, with some auction sales showcasing premiums of up to 50-100% over their lesser-maintained counterparts.

- Regularly service your watch: Aim for a professional service every 3 to 5 years to ensure mechanical precision.

- Be vigilant with storage: Store vintage watches in a temperature-controlled, dry environment to prevent the watch's delicate materials from deteriorating.

- Avoid unnecessary exposure: Exposure to water, extreme temperature variations, and strong magnetic fields can significantly degrade a watch's movement and aesthetics.

Harboring the Heritage: The Role of Documentation in Preservation

Maintaining the authenticity of your vintage watch is pivotal. Detailed records and original parts and accessories—such as the box, warranty card, and manual—can enhance the value of a vintage piece. Experts note that watches sold with original papers can increase in value by an estimated 10-20%. Therefore, safeguarding these components is equally as important as the physical maintenance of the watch itself.

Insurance as Investment Protection: Secure Your Heirloom Timepieces

While we don't like to ponder the worst, the reality of loss, theft, or damage looms over any high-value asset. For luxury watches, obtaining a comprehensive insurance policy tailored specifically for valuable personal property is a must. Insurance can provide peace of mind, as well as a safety net, preserving not just the financial investment but the emotional significance of your heirloom piece. Considering the potential value spikes your vintage collection could experience—mentioned in our exploration of market trends—being covered by insurance is a shrewd strategic move.